Oil posts weekly loss on oversupply fears before key market reports

Nov 11, 2025Source

Oil prices were up about 1 percent on Friday but posted a second weekly loss amid oversupply concerns stemming from increasing output and a surprise inventory build-up in the US.

The market is also awaiting next week's reports from OPEC and the International Energy Agency, which would provide clarity on the supply-demand dynamic.

Brent, the benchmark for two-thirds of the world's oil, rose 0.39 percent to settle at $63.63. West Texas Intermediate, the gauge that tracks US crude, added 0.54 percent to close at $59.75 per barrel.

Year-to-date, Brent has lost nearly 15 per cent, while WTI has retreated more than 16 percent.

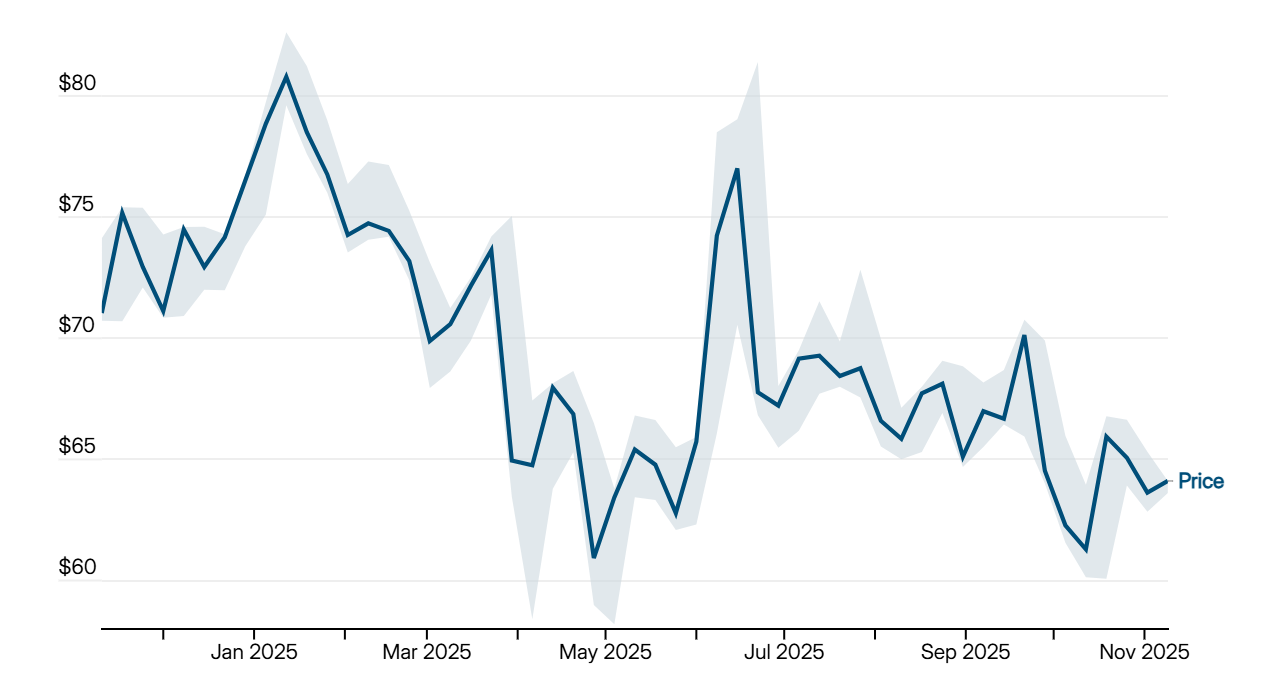

Brent oil price in the past year

Average weekly price in US dollars. The shaded area is the range between the maximum and minimum prices

OPEC+ last Sunday agreed to another output increase for December as the group of oil producers led by Saudi Arabia and Russia continues to bring more barrels into the market.

The group, which also includes Algeria, Iraq, Kazakhstan, Kuwait, Oman, and the UAE, decided to raise production by 137,000 barrels per day for next month, similar to the October and November levels of increase.

The move was in light of a “steady global economic outlook and currently healthy market fundamentals, as reflected in low oil inventories,” OPEC+ said.

Geopolitical disruptions, such as the continuing Russia-Ukraine conflict, US sanctions on Russia's Rosneft and Lukoil, and tensions in Venezuela, have also been adding to market risks.

The UAE's Minister of Energy and Infrastructure, Suhail Al Mazrouei, told this week's Adipec conference that there was no oversupply of oil in the market, with demand remaining strong due to the artificial intelligence and data center boom.

However, the eight OPEC+ countries also agreed to pause oil output increases for the first quarter of 2026.

The US Energy Information Administration said on Wednesday that crude inventories in the world's biggest economy grew by around 5.2 million barrels last week, defying market expectations of a decline of about 2.4 million barrels.

That was the largest rise since July, driven by higher imports, slower exports, and subdued refinery runs during maintenance, contributing to a “worldwide crude outlook [that] remains bearish,” said Vijay Valecha, chief investment officer of Dubai-based Century Financial.

“Even with some short-term support stemming from concerns about Russian supply and tensions in Venezuela, growing inventories and weak manufacturing data in key economies outweigh the concerns,” he said.

With the IEA having warned that the projected 2026 oversupply could be even larger than previously estimated, “deteriorating market sentiment” is slowly growing, added Soojin Kim, a research analyst at MUFG Research in Dubai.

The Paris-based IEA last month raised its global oil supply projections for 2025 and 2026 amid OPEC+'s production increase and is now projecting world oil supply to rise by 3 million barrels per day to 106.1 million this year and 2.4 million next year.

These factors are “intensifying worries about a growing global supply,” Ms Kim said, with the overall market tone remaining “bearish as supply growth continues to outweigh disruption risks despite lingering volatility.”