Where are UAE residential prices and rents heading in 2026?

UAE residential prices and rents are expected to grow at a slower pace in 2026 compared to previous years on the back of more supply entering the market, according to analysts.

Around 120,000 units are scheduled for handover in Dubai in 2026, which will “likely put pressure” on prices and rents in the emirate, Anton Lopatin, senior director at Fitch Ratings, told The National.

Total estimated supply in the market doesn’t take into account potential delays in the handover of homes.

“We expect UAE residential price and rent growth to continue moderating in 2026. A moderate correction is possible, driven by a widening supply-demand imbalance—particularly in Dubai,” Mr. Lopatin said.

Prices and rents are already recording a slowdown in growth in Dubai this year, Fitch data shows, with prices rising by about 13 per cent year-on-year in November—down from roughly 18 per cent annual increase in January.

Rent growth is also easing on average, slowing to about 6 percent year-on-year in November from 14 per cent in January.

“The Dubai residential market is transitioning into a more balanced phase following several years of exceptional growth,” said Prathyusha Gurrapu, head of research at Cushman & Wakefield Core.

“Price appreciation is forecast to moderate to mid-single-digit levels of around 5 to 8 per cent in 2026, a marked slowdown from the 12 to 22 per cent annual growth recorded during 2024–2025.”

Rents are also expected to “stabilise or record modest low single-digit growth” as new inventory is delivered, she added.

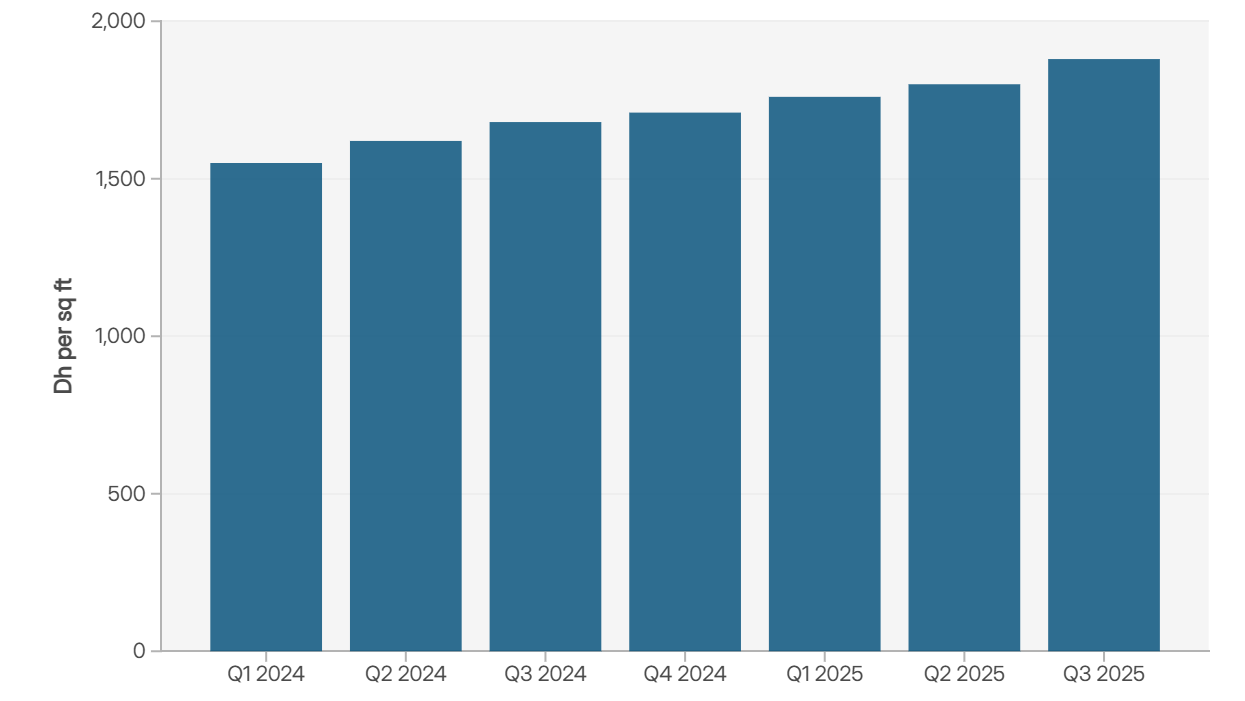

Dubai residential prices 2024 to Q3 2025

Prices have continued their upward trajectory, up 4.5% quarter-on-quarter in 2024 and 16.1% year-on-year between 2024 and 2025.

Property prices and rents have been on an upward trajectory in the UAE since the pandemic as more people chose to relocate to the Emirates amid a growing economy and new opportunities.

Government initiatives such as residency permits for retired and remote workers, expansion of the 10-year golden visa programme have also helped to support the property market.

Dubai’s population grew 4.47 per cent year-on-year, reaching 4.03 million residents as of October 2025 − an average of roughly 470 new residents arriving each day, according to a recent data from Springfield Properties.

Abu Dhabi’s population also grew to cross 4 million in 2024, boosting demand for property in the emirate.

An influx of a large number of high-net-worth individuals to the UAE also pushed prices and rents higher due to strong demand.

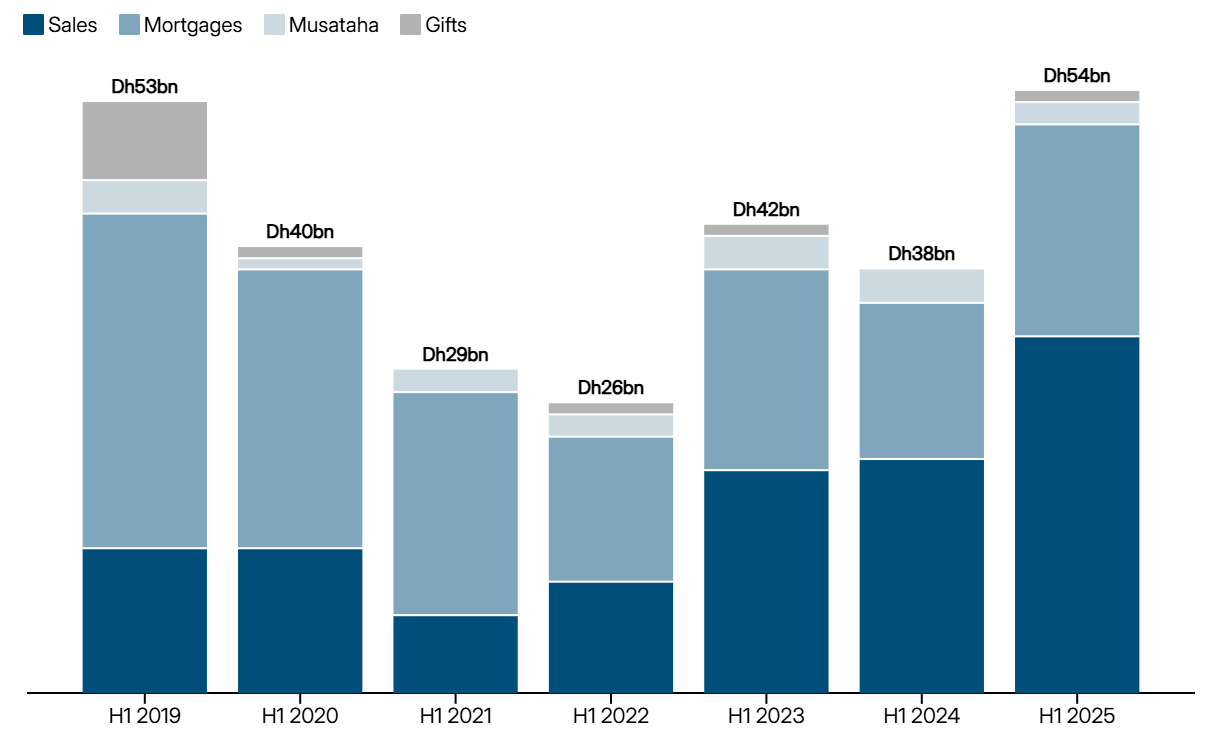

Total H1 real estate transactions in Abu Dhabi

Last year, the UAE welcomed 7,200 millionaires, building on an influx of 4,700 in 2023 and 5,200 in 2022, data from Henley & Partners shows. The total number of dollar millionaires in the UAE stood at 130,500 at the end of December, ranking the Emirates as the 14th-largest wealth market globally.

“As we mark the fifth anniversary of uninterrupted price growth in this third freehold residential market cycle in Dubai, we have begun to see a slight slowdown in the rate of price increases,” Aliaa Elesaaki, senior research manager for Egypt and the UAE at Knight Frank Mena, said.

Prices in Dubai climbed by around 2 percent per quarter in 2021 and 2022 and increased further in 2023 and 2024 with prices growing at a faster rate of 4.3 per cent quarterly.

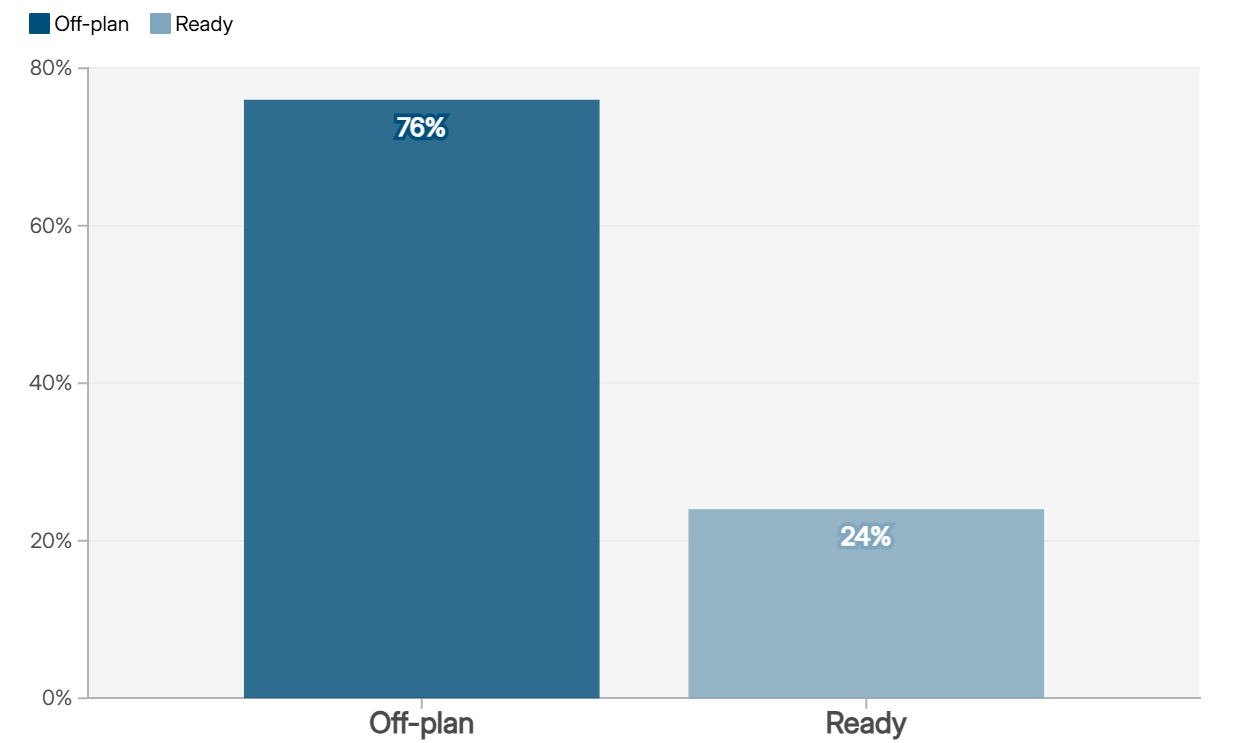

Off-plan property sales dominate UAE market in Q3 this year

The UAE market has become increasingly focused on future developments, with activity up 72% year-over-year, driven largely by payment flexibility and developer incentives.

For the first nine months of 2025, prices increased by around 3.2 percent per quarter, according to Knight Frank.

“Given property prices have increased by around 78 percent throughout the course of this residential market cycle, it is natural for the rate of price increase to show slightly slower growth,” Ms. Elesaaki said.

Abu Dhabi market

The property market in Abu Dhabi is expected to remain tight amid higher demand and limited supply, according to analysts.

Ms Gurrapu said Abu Dhabi has shown strong market momentum, with residential prices rising by about 30 percent year-on-year in December and rents up 23 percent, driven by robust socio-economic fundamentals and attractive relative value compared with other global cities.

About 6,500 new residential units are forecast to be delivered in Abu Dhabi in 2026 amid continued population and employment growth, she said.

As a result, market conditions are likely to stay tight, supporting additional price and rental growth of 8–12 per cent in 2026, as limited new supply continues to bolster both sales and leasing activity, she added.

Abu Dhabi property deals in the first half of 2025 surged by 42 per cent on an annual basis as demand remained strong amid a population increase and robust economic growth.

The total value of deals over the six months to the end of June reached Dh54 billion ($14.7 billion), driven by residential unit sales that rose by 38 per cent to Dh25 billion, according to a report from Abu Dhabi Real Estate Centre in September. The volume of property transactions jumped 25 per cent to 15,578.

“Abu Dhabi has shown steadier fundamentals, pointing to continued moderate price increases through mid-2026, buoyed by sustained demand and a more conservative supply pipeline,” Ronan Arthur, director and head of residential valuation at Cavendish Maxwell, said.

Get In Touch

Latest Blogs

Etihad Rail Abu Dhabi: Connecting the UAE’s Emirates by Rail

Hamdan bin Mohammed reviews Jumeirah Beach 1 development project

Office for Rent in Business Bay: A Complete Guide for Businesses